LIVE UPDATES: All 34 district courts in Moscow have been taken under guard by Kazachya Strazha [Cossack Guard], Ltd, a security company founded in 2014 by the Central Cossacks Host

Welcome to our column, Russia Update, where we will be closely following day-to-day developments in Russia, including the Russian government’s foreign and domestic policies.

The previous issue is here.

Recent Translations:

–The Non-Hybrid War

–Kashin Explains His ‘Letter to Leaders’ on ‘Fontanka Office’

–TV Rain Interviews Volunteer Fighter Back from Donbass

–‘I Was on Active Duty’: Interview with Captured GRU Officer Aleksandrov

UPDATES BELOW

“Thanks to the republic for those who are alive, thanks to the first president of the republic, the current leader. He is working effectively.”

“Due to the fault of the enemies of Russia, we suffered a bloody tragedy, but found within ourselves the forces to destroy the numerous bands of Western intelligence services and restore peace. Hundreds of thousands of residents of many regions of the country took part in the rally. They gave a decisive rebuff to those renegades who sold out to the West, who have only one goal, to plunge Russia into chaos and subject it to the will of the USA and its allies. This will never happen! We have enough force and will! Russia was and will be a great power!”

Kadyrov also made a further clarification about the opposition in another post on Instagram on January 23:

“The term non-system opposition was conceived so as to be involved in anti-government activity under that mask. The very title serves as a safe conduct. Tell them who they really are, and the wailing starts up immediately. If a person shamelessly helps enemies of your Motherland, what do you need to call him if not an enemy of Russia? And an enemy must be isolated. Under the slogans of democracy, they give the floor to [Chechen government in exile leaders Akhmed] Zakayev and [Movladi] Udugov and the like, multiplying their threats. They are indeed enemies of Russia and the law.”

Opposition member Ilya Yashin, deputy chair of the Parnas party, said:

“Obviously, Ramzan Kadyrov’s statements relate not to those who go outside the law, but on the whole, to critics of the current regime.”

“Dear Friends! The rally in Grozny is a signal for all our antagonists and open enemies. And it is not important who they are — soulless people who have betrayed their Motherland, who have registered in the offices of Western embassies, fugitive traitors, or leaders of hostile countries! this demonstration cannot be viewed as a local phenomenon of the Chechen Republic. This is an All-Russian people’s gathering! It accurately and clearly gave answers to the questions concerning everyone, made a statement about popular unity, and resolve to give a worth rebuff to those who try to blow up the situation from inside!

This is a mandate from the President of Russia Vladimir Putin to take any measures in the interests of the people and the Fatherland! Look at this footage. Thousands of cars are going to Grozny from Dagestan, Ingushetia, Northern Ossetia, Stravropol Territory, Kabardino-Balkaria, Karachai-Cherkassia, and Kalmykia. Tens of thousands of people arrived from all the regions, starting with Eastern Siberia and ending with Kaliningrad. I am sincerely grateful to all those who had put aside their affairs and became a participant in such an important event for every Russian! We believe in Russia, we believe in our national leader!”

In a report on the rally, Memorial Society’s Human Rights Center questioned whether a million people had really shown up for the march, and said that people reported being forced to go by their bosses. A few of the pictures snapped at the march and published by Memorial showed the casual way in which people treated the portraits of both Putin and Kadyrov.

In it, he recalls a work by Dmitry Furman describing the Chechens as “the most difficult people in Russia,” and notes a recent blog post by Alexei Navalny in which he accused Kadyrov of planning to separate Chechnya from Russia and “create his authoritarian state under the guise of Islamic slogans.” Navalny invoked the idea that Chechens had “fought for Hitler,” which is an old Soviet propaganda meme.

Piontkovsky said he feared Navalny was preparing his many readers for supporting a plan by Moscow siloviki (army and intelligence) to “restore Constitutional order” in a third Chechen war, which Piontkovsky said would be “a disaster”; he implied that Russia should shed its imperial past and let Chechnya go.

In fact, in the piece as it was originally published, Piontkovsky had a more open call for “full state independence with all the legal consequences for our bilateral relations,” but as Oleg Kashin noted in a Facebook post, the last two sentences of Piontkovsky’s articles were later removed.

The liberal opposition and media — and some Western commentators — have spoken often in the last year about a supposed battle between the Federal Security Service (FSB) and Kadyrov, in which Kadyrov seems to be prevailing. The Nemtsov murder illustrates this, because the chief defendant, Zaur Dadayev, has been praised by Kadyrov, but his battalion commander, Ruslan Geremeyev as well as his driver, Ruslan Mukhatdinov, said to have organized the assassination, have both fled Russia before the FSB could question them — and likely not without the help of Alexander Bastrykin, head of the Investigative Committee, who delayed the paperwork to charge them saying there was insufficient evidence.

— Catherine A. Fitzpatrick

The performance of world markets and the price of oil over the last month or so can be summarized in a single word — volatile. Massive falls, and rises (and falls) in both markets and oil prices can be blamed on reactions to news events and economic indicators that have been a mixed bag, really.

The Wall Street Journal provides some context:

“The market is going through a turbulent time, and we’re just hunkering down and waiting it out,” said Alan Gayle, director of asset allocation at RidgeWorth Investments, which manages $39 billion.

Mr. Gayle doesn’t forecast a recession in the U.S. economy, which is why he doesn’t expect U.S. stocks to go into freefall. Still, he said he’s been trimming his exposure to what he views as the more volatile parts of the market, including U.S. small cap stocks and international stocks.

The S&P 500 has declined roughly 8% this year.

Stock swings have also widened. The S&P 500 has posted four swings of at least 2% so far this year. At this time last year, the index had notched zero daily moves of 2%.

“The kind of moves we’ve seen in the first weeks [of the year], both on the pummeling and on the bounce, have been very oversized,” said Art Hogan, chief market strategist at Wunderlich Securities.

Global Stocks Drop as Oil Prices Resume Slide

A further fall in oil prices ended a brief recovery in global stocks Monday, even as Asian shares closed higher after a strong finish on Wall Street. Brent crude oil was down 3.4% at $31.09 a barrel, erasing gains made during Asian trade, and weighing on shares of energy and basic resource companies.

But on Friday oil, and the ruble, saw huge gains. Reuters reports:

The biggest two-day rally since 2008 on Thursday and Friday helped put a stop to what analysts called an “irrational” sell-off that had sent oil prices crashing over 20 percent in January.

Brent hit a 12-year low of $27.10 on Jan. 20, before the two-day rally, while U.S. futures hit a 13-year low of $26.19, below the pivotal $30 levels.

The 15-percent rebound came as traders raced to close out short positions and a monster blizzard moved toward the U.S. East Coast. It was nearly the largest ever two-day rally, while the renewed selling on Monday added to oil market volatility.

“Friday’s advance was an overreaction to the storm,” said Jim Ritterbusch of Chicago-based oil consultancy Ritterbusch & Associates.

Ritterbusch said the reversal on Monday comes as “the market is forced to refocus on various fundamentals that are set to become even more negative.”

Oil climbs further on short-covering, Brent at over $32

SEOUL Crude oil futures extended gains in early Asian trade on Monday on short-covering demand, with both Brent and U.S. crude near$32.50 a barrel. Oil prices surged 10 percent on Friday, one of the biggest daily rallies ever, as bearish traders who had taken out record short positions scrambled to close them, betting the market's long rout may finally be over.

Before today’s drop in oil prices, some analysts were discussing an oil rally. The logic goes that last week’s low prices were an overreaction to news that Iran would begin selling oil, and once investors got used to the current market then oil prices would rise to a more “rational” level. Time Magazine reports:

Adding to the upsurge was growing speculation that central banks around the world will take additional action to provide some monetary stimulus amid worrying signs of faltering growth. EU central bank chief Mario Draghi provided the clearest indication yet that his institution may act as soon as March.

It’s a little premature to say a rally is on, but oil prices are going to have to rise at some point with so much production currently underwater. CMC Markets, a U.K.-based trader, says that $34 is the next resistance point for oil, from a technical perspective. If oil can break above $34 per barrel, then the rally could have some momentum.

At the World Economic Forum in Davos, Nigeria’s oil minister Emmanuel Kachikwu said that he expects oil to rise to $40 by the end of the year. Oil prices could get worse in the short-term, but “the second half of this year holds more promise,” he said.

Oil may rally someday, but clearly today was not that day.

The ruble’s fate is similarly tied to the price of oil, and at mid-day (Moscow time) today The Moscow Times was noting the ruble’s rally:

The Russian ruble — which hit historic lows against the U.S. dollar earlier this month — started to regain some of its losses amid surging oil prices, the Interfax news agency reported Monday.

As of Monday morning, the ruble was trading at 76.71 against the U.S. dollar, its strongest position in ten days. The ruble also strengthened against the euro, trading at 82.99 to the European currency.

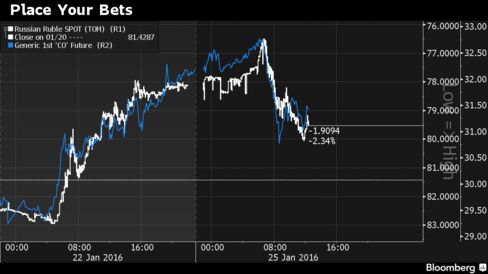

By the middle of the day on the east coast of the United states, however, Bloomberg had a different tune: “Ruble Slides Most in Emerging Markets as Oil Slump Resumes.”

The ruble fell the most among developing nations as the slump in oil resumed and concern mounted the world’s biggest energy exporter will struggle to emerge from recession.

Russia’s currency retreated 2.2 percent to 79.7730 as of 7:14 p.m. in Moscow, reversing gains of as much as 2.1 percent that made it the best performer among peers. Brent crude, which is used to price Russia’s main export blend, weakened 4.5 percent after climbing 2 percent.

“The correlation between oil and the ruble remains elevated,” said Artem Roschin, a currencies dealer at Aljba Alliance bank in Moscow. “The volatility of oil and hence the ruble is very high.”

The ruble’s 30-day correlation with oil was at 0.76 on Monday, near the highest since October, according to data compiled by Bloomberg. A value of 1 would mean the two are trading in lockstep.

Ruble Rally Fizzles as Oil Slide Sparks Biggest Drop Among Peers

Ruble Rally Fizzles as Oil Slide Sparks Biggest Drop Among Peers

The ruble fell, reversing earlier gains as crude prices resumed declines, rekindling concern the world's biggest energy exporter will struggle to emerge from recession. The Russian currency went from being the best performer in developing nations at the open to the worst, gaining as much as 2.1 percent before retreating 2.3 percent to 79.83 as of 2:59 p.m.

As of writing, the ruble is trading at 80.1107 to a dollar, effectively the worst it’s been all day. The ruble is currently trading at 86.9118 to a euro.

So has the ruble reached the bottom? Bloomberg, which has largely been negative on the prospects of the ruble, discussed today the chance that the exchange rate could hit 100 to a dollar.

Can Russia Handle Ruble-Dollar Weakening to 100?

Daragh Maher, head of FX strategy – U.S. at HSBC, and David Goldman, head of the Americas at Reorient, examine the weakening of the Russian ruble against the dollar and the link between the ruble and oil. They speak on "Bloomberg Surveillance." (Source: Bloomberg)

Russia’s problem is that even if oil recovers to $40, the 2016 budget was set with the expectation that oil would be $50 a barrel. Every day below that mark means a lot of lost money for the Russian government, many Russian business owners, and the Russian economy in general. For investors looking at making long-term investments in the Russian economy, no short-term rally is going to sooth investors and trigger economic upswings (and as today proves, the market is so volatile that it’s nearly impossible to analyze them in real-time).

The impact of the devalued ruble is also difficult to judge. Short-term swings may only impact the wealthiest investors and speculators. In general, a devalued ruble increases the prices of foreign goods, and that may drive many western companies out of Russia. A bad ruble could make exports more competitive in the global market, but Russia has alienated major trading partners like Ukraine and Turkey, and there’s no sign of Russian-manufactured goods being particularly in demand elsewhere. Furthermore, so much of the collapse in the stock markets has to do with China’s struggling economy — a problem for Moscow which has hoped that sales to China would replace sales lost to Europe.

Meanwhile, 2015’s economic news is worse than many expected, and it looks as though Russia will enter into its second year of recession. The Telegraph reports:

The country’s GDP dropped by 3.7pc last year, according to state-run statistics agency Rosstat, after the Russian economy eked out growth of just 0.7pc in 2014. Analysts had expected a fall of 3.8pc.

…

Fixed investment fell by 8.7pc year-on-year in December, after a fall of 4.7pc in November. Retail sales also shrank by 15.3pc year-on-year, after a drop of 13.1pc in the preceeding month.

“The data were much weaker than most analysts had anticipated,” said Mr Jackson, adding that Russian economic “activity weakened markedly towards the end of the quarter”.

— James Miller

The demonstrators held posters saying “Is anyone who thinks an enemy?” “Putin, rein in your oprichniki,” (using a term for the Tsar’s fierce secret police) “the Constitution should be read to children, it is the nicest fairy tale,” “bandits in the Kremlin, patriots in prison,” and “courts are the disgrace of Russia.”

Mark Galperin said only a mass movement to remove such officials from power could change the situation in Russia; while people could vote in the elections, the opposition would never win there, which is why a “a democratic, peaceful, unarmed revolution” was needed.

Andrei Nechayev, chairman of the Civic Initiative party said it was clear the government “feared its own people” and the failure of its own state propaganda in the face of the economic crisis, which is why it was cracking down.

The official court bailiffs still retain the function of checking ID and maintaining public order during the day.

The need for the Cossacks arose when the budget was cut for official court security employees last year, as we reported.

($41,521) to 4.2 million ($52,720), based on the calculation of 10 shifts of 140 men).

From pictures of the Cossacks guards supplied by the Central Cossacks Host, it appears that they are not carrying firearms but have police clubs.

Cossacks have been deployed officially in security functions, such as rooting out sanctioned food products in St. Petersburg, and unofficially, in the Anti-Maidan group which has harassed and even beaten liberal demonstrators.

In reply to a query to the Kremlin, RBC learned that Aleksandr Beglov, presidential representative to the Central Federal District, recommended the Cossacks for the job. Beglov also serves as the presidential advisor on Cossack affairs, but had no comment for RBC.ru. Gudkov said that the issue wasn’t the use of private contractors as state guards, which is a worldwide practice, but hiring without an open tender.

— Catherine A. Fitzpatrick